Shares of AIA Group Limited should be included in the investment portfolio of investors interested in securities of Asian companies. This asset is suitable for long-term investments. The company pays dividends, so AAGIY shares may be of interest to investors interested in receiving passive income.

AIA Group Limited is an Asian group of insurance companies. The corporation was founded in 1919 in Shanghai by Cornelius Vander Starr. Now the branches and subsidiaries of the AIA Group serve clients in 18 markets, including Vietnam, Thailand, Singapore, New Zealand, Australia, and others. The Asian insurance group is headquartered in Hong Kong.

AIA shares were listed on the Hong Kong Stock Exchange in 2010. At the time of the IPO, the company attracted an investment of $ 17.9 billion. At the time of the initial public offering on the Stock Exchange, the AIA Group shares traded at $2.79. The IPO came after the cancellation of a deal with Prudential PLC, a British insurance company that was planning to buy American International Assurance Company.

AIA Group is an insurance and financial corporation that provides services to individuals and businesses in the Asia-Pacific region. The company offers life insurance, wealth management, and health and casualty insurance. AIA also provides commercial, retirement, and investment services.

In 2012. AIA acquired more than 92% of Aviva NDB Insurance, which is based in Sri Lanka. In the same year, the corporation acquired the Malaysian insurance subsidiaries of ING Group. AIA also enters into bancassurance-type agreements with Asia's largest financial institutions, such as Citibank.

The company's management has noted increased interest in AIA's products and services. This is due to low competition from private insurance firms in the Asian market and limited social security coverage. At the same time, in the first half of 2022, the share price of AIA Group was highly volatile. Analysts attribute sharp jumps in AAGIY stock prices to supply chain disruptions, labor shortages, and rising energy prices. AIA's share price is also affected by the tense geopolitical situation in the world.

In March 2022, AIA Group announced that it had applied to list a $12 billion borrowing program on the Hong Kong Stock Exchange. The corporation plans to issue medium-term bonds and shares over one year. AAGIY quotations reacted to this news by falling more than 3%.

At the end of May 2022, the China Banking and Insurance Regulatory Commission approved the establishment of a new branch of AIA Group in Henan Province. The corporation has already begun preparations for the branch opening. The company's expansion is part of the growth strategy pursued by the insurance firm's management.

The company's capitalization in 2021 was $75.0 billion, up 13% from 2020. The free surplus increased by $3.6 billion to US$17.0 billion. Corporation management reported that $2.4 billion was invested in the company's development in 2021.

The company said that investors received $10.0 billion in 2021 under AIA's share repurchase program. In addition, the corporation pays dividends to security holders. The final dividend payout for 2021 was 108 Hong Kong cents per share. The board of directors noted that the repurchase of securities will take place over the next three years.

Analysts consider AAGIY Stock a suitable asset for long-term investing. In the long term, AIA stock will bring its owners about an 8% yield per year. On July 13, 2022, the Asian insurer's securities were valued at $42.38. Experts set the target price of AIA shares at $54.6 by 2027. At that, analysts assume that the quotes will not collapse in the next year and will not exceed the $100 mark by the end of 2022.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

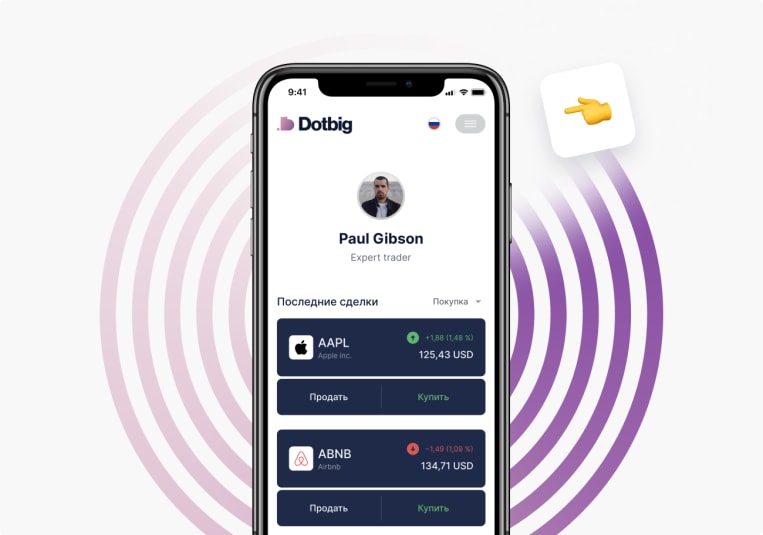

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading