Goldman Sachs shares are part of the banking sector on the stock market. This company has earned the title of one of the most famous investment banks in the world. Before you start investing, we recommend reading Goldman Sachs financial report and studying analysts' forecasts.

Goldman Sachs Group is included in the list of the world's largest investment banks. This financial conglomerate was founded in 1869. At its very origins stood Marcus Goldman and his son-in-law Samuel Sachs. This financial giant participated in IPOs of major companies such as Microsoft, Yahoo, Twitter, etc. In September 2013, the bank entered the Dow Jones Industrial Average.

Goldman Sachs shares are listed on the New York Stock Exchange under NYSE: GS. The company's IPO was held in 1999. In its initial public offering, Goldman Sachs stock was largely distributed to long-term investors, former partners, and employees of the bank. Only 12 percent of the company's securities were released to the market for a total of $3.6 billion.

One of the largest banks in the world provides services in several areas. These include investment banking, asset management, and lending. Investment Banking provides services related to takeovers, restructurings, IPOs, stock purchases, etc. The company works on global stock, commodity, and currency markets and often acts as an intermediary and market maker. The investment Banking segment is divided into three main areas: fixed income investments, foreign exchange, and commodity activities.

The Private Banking division serves large private investors. This segment provides lending, deposit-taking, and asset management services. Representatives of the bank also provide financial advisory services. The financial conglomerate provides asset management services to large and institutional investors.

In the first half of 2022, a crisis period began for the global stock market. Many companies noted a drop in quotations and profits. During the crisis period for the stock market, investment banks are feeling the pressure particularly acutely. So, the share price of Goldman Sachs during the first six months of 2022 was characterized by increased volatility. To restore its financial performance, Goldman Sachs is gradually mastering the fintech sphere to get an additional source of stable income.

As of the beginning of July 2022, Goldman Sachs's share price is down more than 22%. This year, inflation is at its highest level in 40 years, and the rate of increase in interest rates is now at its fastest pace in 30 years. In addition to all of this, the S&P 500 Index has lost more than 20% in the first half of 2022.

Goldman Sachs' financial performance in 2022, like that of many other central banks, has not seen much growth. The company's investment banking revenue fell 41% year over year in the second quarter. In all, Goldman's revenues were down 25% in the first half of 2022 and net income fell 45%.

Despite the challenging macroeconomic environment, Goldman Sachs continues to find sources of revenue. In volatile financial markets, the bank has declining revenues in investment banking and wealth management. However, massive trading operations continue to generate profits due to the increased volatility of asset prices. Thus, in the direction of fixed-income trading, the company's profit increased by 55% year-on-year. The financial conglomerate's quarterly trading income in Q2 2022 was $6.5 billion.

Goldman Sachs had earnings per share of $7.73 in the second quarter. The company's total revenue was $11.86 billion. The bank's return on tangible capital during the quarter was 11.4%, below its medium-term target of 15% or higher. Meanwhile, the company continues to work to diversify its revenue sources.

Given current earnings guidance for 2022, Goldman Sachs's stock price target is around $380. Based on technical analysis, we assume that the NYSE: GS asset will trade in the $390-410 range by 2025. Goldman Sachs stock will be trading at a price far from its all-time high in the coming months. However, many analysts and investors see a drawdown in the stock price of such a large company as a good time to buy securities.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

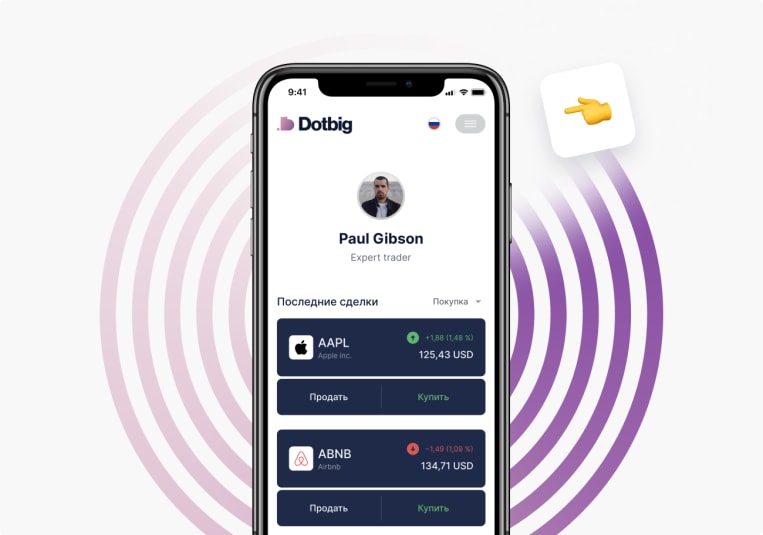

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading