Illumina shares are among the assets of the biotechnology sector on the stock market. The company is one of the leaders in its field, so it attracts the attention of investors. To understand if this is a good time to buy Illumina stock, check out this market player's financial results and analysts' forecasts.

Illumina is an American company that manufactures and sells DNA sequencing products and services. The company is headquartered in San Diego, California. The corporation was founded in April 1998 by David D. Walt, John Stuelpnagel and Anthony Charnick with initial funding of $600,000. The name Illumina comes from the Latin word meaning "light."

Illumina is a publicly traded company on the Nasdaq Stock Exchange, a leading provider of sequencing solutions and arrays for genetic analysis. The company has a market capitalization of more than $30 billion and its products are used by researchers in more than 100 countries.

The company's first product was a chip that could be used to sequence the genome of the bacterium Escherichia coli. Since then, the company has developed a number of sequencing products and services for a variety of applications, including whole genome sequencing, cancer research and agricultural genomics.

In 2013, Illumina acquired Solexa, a British company that was developing sequencing technology. This acquisition made Illumina the world's largest company in its field. In 2015, Illumina announced that it would be acquired by the Swiss pharmaceutical company Roche for $8.3 billion. However, the deal was later terminated by Roche. In 2018, Illumina acquired Pacific Biosciences, a U.S. company that develops sequencing technology.

As of Oct. 18, 2022, Illumina's stock has lost about 45% of its value since the beginning of the year. However, there was an upward spike in the stock price in October. In one day, Illumina's stock price was up 8%. This came after the corporation announced its development of a faster gene sequencing machine.

Despite the rise in revenue, Illumina stock can still be considered a risky asset. The corporation projected an annual securities loss of about $2.9 per unit of that asset. Such disappointing near-term forecasts are related to inflation, lower spending by the corporation's customers on medical devices, and the strengthening of the dollar. Another factor affecting Illumina's financial performance is the economic downturn in China.

Illumina stock has outperformed the market in recent years and has nearly tripled in value since 2013. Illumina is a leader in its industry, and its products are used in a variety of important areas. The company has a strong financial position and its stock is outperforming the market.

Illumina is the largest provider of sequencing services and tools, with more than 70% market share. The company's products are used in a variety of fields, including cancer research, diagnostics and reproductive health. Sequencing is a fast-growing market, and demand is expected to increase significantly in the coming years. Illumina is well positioned to take advantage of this growth because of its strong product portfolio and large user base.

Illumina's products are primarily used for research purposes. This means that demand for the company's products is heavily dependent on government funding for research. If it is cut, demand for Illumina products is likely to decline, which will negatively affect the company's financial performance.

Illumina faces stiff competition from other companies in the sequencing market, such as Thermo Fisher Scientific and Oxford Nanopore Technologies. These companies are well-established and hold significant market share, making it difficult for Illumina to gain market share.

In the second quarter of 2022, the biotech giant's revenues were $1.16 billion, 3% higher than in the same period last year. It is worth noting that up to this point, revenue had been growing for 8 quarters, with one exception. As of November 2022, Illumina had more than 9,000 customers worldwide. The company continues to serve its large customers with equipment maintenance assistance.

During the quarter, Illumina posted a loss per share of $3.40. Last year, the company posted earnings per security of $1.26 in the second quarter. In addition, the corporation expects an annual loss per Illumina share of $2.9 by the end of 2022.

At the time of the Illumina stock price technical forecast (Nov. 25, 2022), the stock price was at $219. Given the current difficult geopolitical situation in the world, the corporation's stock price could fall to $185 in 2023. Some analysts also believe that Illumina's stock price will remain at $222 in 2023. By 2025, there's a chance the stock could rise to $245. If the company continues to grow and expand its equipment supply to the market, ILMN stock has the potential to rise to $780 and higher by 2030.

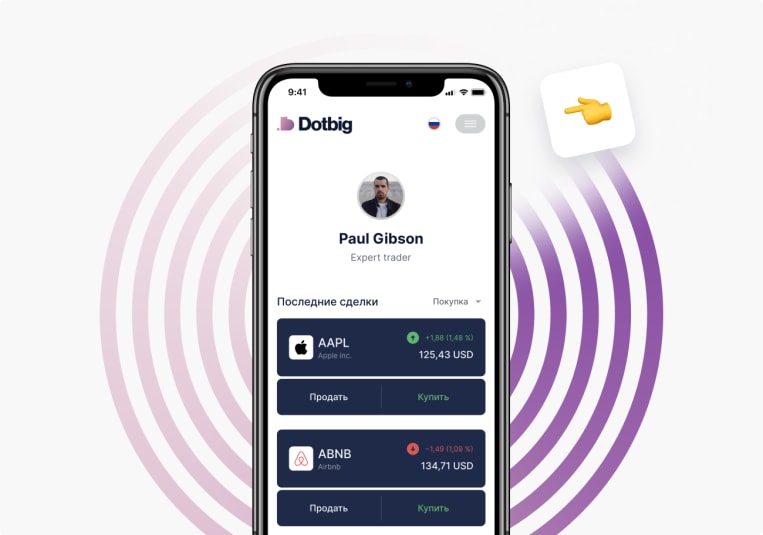

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading