Nike attracts the attention of buyers and investors with its steady growth in sales and sound management. Nike stock is considered a promising asset for long-term investment. Short-term jumps in quotations allow private investors to earn on a speculative strategy.

Nike is one of the world's largest sports brands. The history of the company began in 1964. Its founders are athlete Phil Knight and athletic trainer Bill Bowerman. The athletic shoe brand was originally called Blue Ribbon Sports and was renamed Nike in 1971.

The company grew rapidly and increased revenues from $2 million to $269.8 million between 1972 and 1980. Revenues and net income during this time roughly doubled from year to year.

The company's IPO was held in 1980. Nike stock traded at $22 per paper at the initial offering. The stock was listed on the NASDAQ over-the-counter market. The brand conducted a 2:1 split of Nike stock seven times. This procedure allowed for a reduction in the value of the securities.

Nike operates on nearly every continent. The brand's products are shipped to markets in Asia, Europe, Africa, South America, and North America. The North American market brings the company more than 35% of its total revenue.

Nike is one of the top leaders among manufacturers of sporting goods. The company has more than 110 factories for the manufacture of shoes and more than 330 facilities where the clothing of the brand is sewn. The main production facilities are located in the PRC and Vietnam.

Under the Nike brand products are produced by several brands. The company offers customers a different line of sports shoes and apparel: Golf, Team Starter, Air, LeBron, and Space Hippie. Converse and Hurley International brands are also under Nike's control.

In its latest quarterly report (March 2022), the company displayed sales results for all regions. For example, revenues in Asia and South America were up 11%. Sales growth is also seen in Europe, Asia, and the Middle East. Nike's revenue in China was down 5 percent from the same period in 2021. The sports apparel and footwear supplier reported sales growth in all product groups. Nike shares have started to fall in price despite the positive financial results and revenue growth since December 2021. In the background of falling demand for the products in China and under the influence of other factors, the quotes for six months dropped by about $ 60 per share.

In March 2022 Nike reported the suspension of sales in Russia through the company's website and app. The management of the brand explained this decision by the impossibility of guaranteed delivery of goods in the Russian Federation. At the same time sales, in-ground stores continued.

Nike has collected on the reserve accounts $13,5 billion, this money is a financial cushion, which guarantees shareholders stable dividends. In the first 3 months of 2022, the company distributed $1.7 billion through share repurchases and dividend payments.

Nike posted revenue of $12.3 billion in the fourth quarter of 2021, up more than 90 percent from the same period last year. During the three months, the company earned $11.6 billion from footwear sales in North America alone.

In March Nike presented its results for the first 3 months of 2022. Financial performance for this period exceeded analysts' expectations. This led to a 2.5% rise in Nike's stock price. Revenue for the three months rose 5% to $10.871 billion. The consensus revenue forecast for this reporting period was $10.62 billion. Nike's net income per share declined from $0.92 to $0.88.

Nike's management presented its outlook for its financial performance in 2022. The company's management expects its annual revenue to rise by 10% (to $49 billion). For April-June, Nike forecasts a decline in sales in North America and an increase in demand for its products in China.

In March 2020, Nike stock was trading at $60 per paper. After the coronavirus pandemic began, quotes began to rise.

Log into your personal DotBig account and fund your account with $100 or more. After that, choose a trading terminal and trade the Nike Stock asset.

During the year (May 2021 through May 2022), Nike stock dropped from $135 to $108 (as of May 12). In August and October 2021, quotes rose above $170.

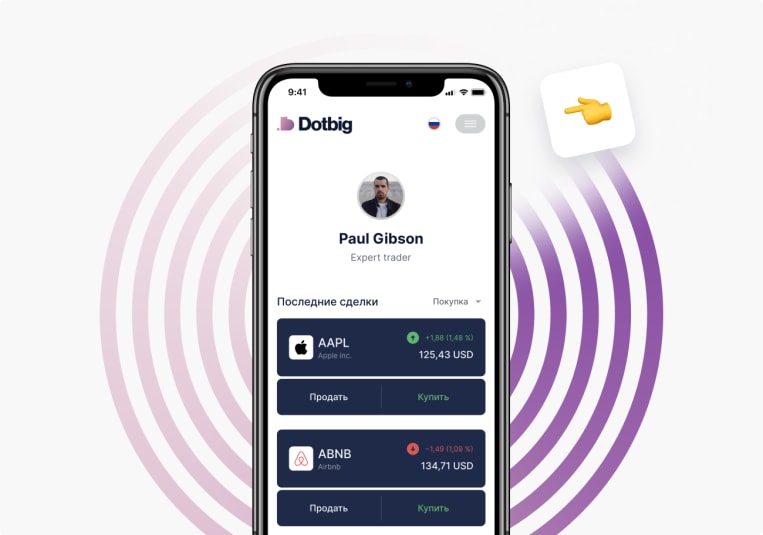

Yes, Nike stock is available to trade in automatic mode on DotBig's copy trading platform. Traders can also use trading robots and trading signals.

Nike's closest competitors are Adidas, Puma, Under Armour, and Asics

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading