Shares of PepsiCo can be classified as defensive assets on the stock market. The beverage and food maker's securities have attracted investors' attention with steady rate increases over several years. In addition, the company pays dividends and is considered a dividend king, increasing distributions to shareholders for 50 years.

PepsiCo is an American food and beverage corporation. PepsiCo was formed in 1965 through the merger of the Pepsi-Cola Company and Frito-Lay, Inc. The date of the appearance of the Pepsi-Cola drink itself is considered 1898, when a pharmacist from North Carolina succeeded in creating a product that tastes similar to Coca-Cola. Caleb Bradham worked in a pharmacy while also selling his invention to soda vendors.

In 1902, Caleb Bradham closed his drugstore and started making Pepsi-Cola, the recipe for which was patented in 1903. Until 1965, the company faced difficulties connected with the First and Second World Wars, in particular the sugar shortage. Since then, however, PepsiCo has grown into one of the world's largest food and beverage manufacturers with a portfolio of more than 20 brands.

PepsiCo is a publicly traded company with more than $60 billion in annual revenues. The company has about 300,000 employees worldwide and is listed in the S&P 500 Index. PepsiCo has shares listed on the New York Stock Exchange under the NYSE ticker symbol: PEP. In October 2022, the corporation had a market capitalization of $238 billion.

PepsiCo is a global food and beverage company with a portfolio of iconic brands including Pepsi, Lay's, Quaker, Gatorade, Doritos and Tropicana. The corporation is headquartered in Perchance, New York and operates in more than 200 countries. PepsiCo products are sold in retail outlets worldwide. The company makes soft drinks, snacks, baby food, salty snacks, fermented dairy products, etc.

In recent years, PepsiCo has faced problems caused by public health concerns about its products, including sugary drinks and processed snacks. As a result, the company has been working to change the formulation of its products and expand its product line to include healthier options. These include the Pepsi Light diet drink, which eliminates sugar from its lineup.

PepsiCo ended the third quarter of 2022 with a strong financial performance. Consequently, the company raised its organic revenue forecasts for the entire current fiscal year. The corporation's management expects this indicator to grow by 12%. Earlier analysts had projected a 10% increase in the company's organic revenue. Earnings per share of PepsiCo in constant currency, according to the new forecast, will grow by 10% by the end of 2022 compared with earlier predicted figure of 8%.

In 2022, PepsiCo entered the list of dividend kings. The corporation has consistently paid a dividend that has been growing for decades. As of October 2022, the dividend yield on the company's securities was at 2.7%. The forward annual dividend was $4.60 per PepsiCo share.

PepsiCo ended the third quarter of 2022 with revenues of $21.97 billion, up from a projected $1.13 billion. On a percentage basis, that figure was up about 9% year over year. PepsiCo's stock posted earnings of $1.95 per security during the three-month period. This figure beat the consensus forecast by $0.11.

It's worth noting that PepsiCo had mixed results in the third quarter of 2022 regarding sales volumes. Production actually declined year over year. At the same time the volume of sales of beverages alone grew by approximately 3%. Most of the corporation's earnings were due to a reduction in income tax provisions. This allowed the company to overcome a slight decline in gross profit and operating margin.

We made our forecast for PepsiCo stock based on its October 19, 2022 value, which was $175 at that time. Taking into account the current unstable geopolitical situation in the world, the analysts forecast the possibility that the corporation's quotations may fall to $140 in 2023. According to an optimistic forecast, by 2025, PepsiCo shares may trade at a price above $180. A 2030 forecast suggests the beverage maker's stock has the potential to rise to $300 to $380.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

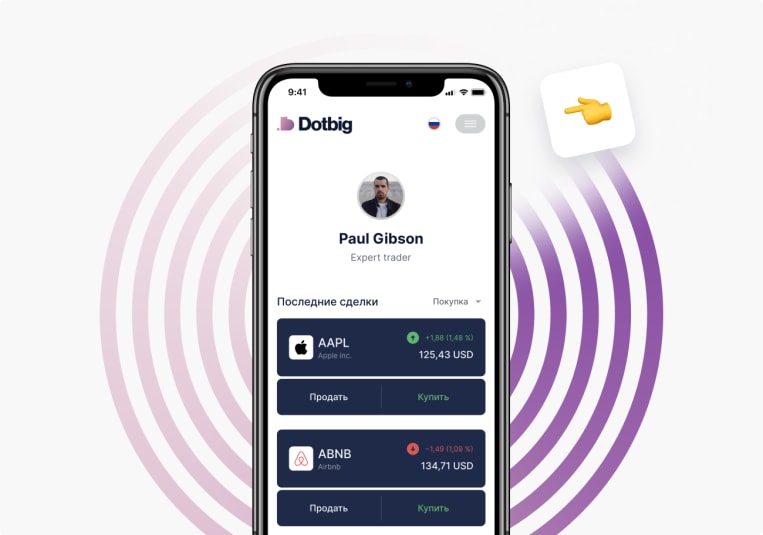

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading