Procter & Gamble stock can be classified as an asset suitable for investment during a recession. The corporation manufactures consumer products for which demand remains unchanged even in times of crisis. We offer a look at P&G's financial results, as well as analysts' forecasts on this company's share price.

Procter & Gamble is one of the world's largest manufacturers of consumer goods. The company sells a wide range of products in more than 180 countries, including products for beauty, health and home care. P&G was founded in 1837 by William Procter and James Gamble. The two men founded the company in Cincinnati, Ohio, and it has since grown into a global corporation. Procter & Gamble is now part of the Dow Jones Industrial Average and is one of the most expensive companies in the world.

Procter & Gamble's stock is listed on the stock exchange under the ticker NYSE:PG. The IPO of P&G took place in 1978. At the initial public offering at Procter & Gamble, shares were traded at $100. The corporation's securities can be purchased on the stock exchange directly or through a broker.

The company manufactures and sells a variety of consumer products, including laundry detergent, cleaning products, personal care products, and food and beverages. In addition to the products it offers, Procter & Gamble also provides services such as product development, marketing, and customer service. The company was an early adopter of television advertising and was one of the first to use celebrity endorsements. P&G was also a pioneer in developing new product categories such as disposable diapers and laundry detergent.

P&G products are among the most recognizable in the world. The company's portfolio includes brands such as Tide, Pampers, Gillette and Oral-B. P&G also owns a number of popular cosmetics brands, including Olay, SK-II and Pantene.

Procter & Gamble's stock price was at $123 in October 2022. Through Nov. 21, the quote had soared to $144. This was due to a strong financial report for the first quarter of fiscal year 2023. The corporation was able to shift some of its rising costs to consumers. A negative factor affecting the company's earnings is the strong dollar, but P&G has managed to overcome headwinds so far.

In fiscal year 2022, the corporation was raising the cost of its products. Thus, the manufacturer of consumer goods had to raise product prices by 8% in the fourth quarter of 2022. This measure was taken against the background of actively growing inflation. At the same time during the three months the company noted a decrease in the volume of goods sold by 1%.

P&G's fiscal year does not coincide with its calendar year. For example, October 2022 marked the end of the first quarter of 2023 for the consumer products manufacturer. During that period, the corporation increased organic sales by 7%. This increase came after P&G's fiscal year 2022 sales growth of 5%.

Despite the increase in sales revenue, volume sold decreased 3% during the quarter. This is due to higher product prices, which the corporation actively applied in the second half of 2022. As a result, in two of the five divisions, customers switched to cheaper products. However, analysts note that consumers have been less willing to accept price increases recently, so P&G management expects less growth in organic sales in the near future.

At the time of the technical analysis on Procter & Gamble's stock price was $145, on Nov. 23, 2022. The range of quotes in 2023 is quite wide, according to the forecast. Procter & Gamble's stock price could fluctuate between $150 and $200. In 2023, P&G's stock price could be negatively impacted by a strong U.S. dollar. However, the company is not going to withdraw from fast-growing regions. In 2025, PG's stock price could surpass the $280 mark.

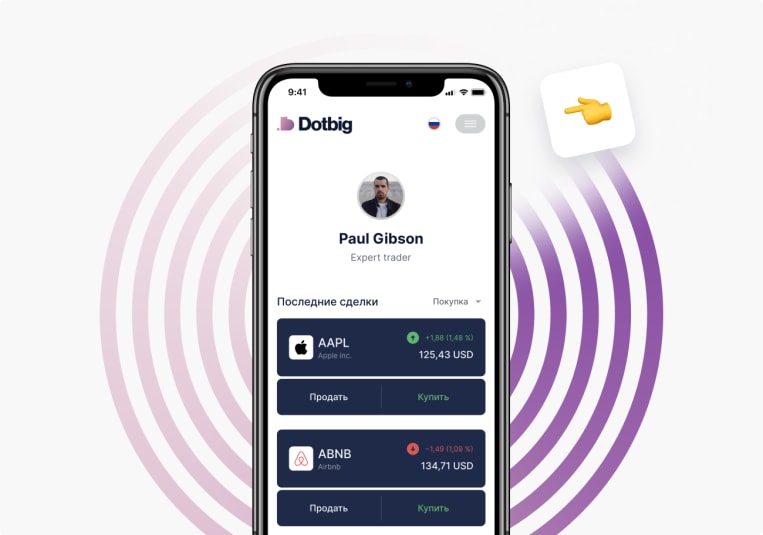

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading