Target stock used to be considered a stable asset that attracted the attention of conservative investors. This major U.S. retailer is a worthy competitor even to retail giants such as Amazon. The corporation is also among the organizations that regularly pay dividends and raise distributions to shareholders.

Target was founded in 1902 by George Dayton. The organization originally traded dry goods and was called Dayton Dry Goods. In the 1950s, the corporation absorbed the Lipmans chain of stores. The first discount store, called Target, opened in 1962. Gradually management began to see profit from the business, which led to the renaming of the retailer to Target Corporation in 2000.

In 2001, the retailer launched a campaign to increase bank card security. The corporation's success depends largely on an effective business strategy. The corporation is known for its well-thought-out marketing programs, high level of customer service and a wide range of products. Target stock is listed on the stock exchange under NYSE ticker: TGT and has attracted the attention of major investors for many years.

The Target retail chain operates in international markets, giving customers access to a variety of product groups. The chain's stores offer home furnishings, children's products, food, jewelry, etc. In 2012, the corporation signed a contract with Apple Inc. that provided for the opening of stores of the manufacturer of the equipment in the Target chain outlets.

Stores of the retail chain operate in almost all states in the United States. The company is also present on the Australian market, where stores under the brand belong to the Wesfarmers. The retailer also operates in Canada. Quite a wide geography of the corporation makes it an international trading network.

As of July 2022, Target's stock has been included in the dividend aristocrat group of securities. Companies with this status have been characterized by consistent dividend increases for at least 25 years and are typically included in the S&P 500 Index. Target has raised its dividend for half a century. In October 2022, the dividend yield on TGT stock exceeded 2.5%. By comparison, the average yield of the S&P 500 Index is at 1.8%.

Target, like many retailers in 2022, is facing a challenge in attracting consumers. In the second quarter of 2022, Target's comparable store sales were up 1.3%. Digital comparable sales were also up 9% during this reporting period. The company has increased this figure for 21 consecutive quarters. The reason for such positive results can be attributed to the retailer's efforts to improve order delivery services. In particular, the company provided customers with the option of same-day pickup. If the corporation continues to increase sales in the second half of the year, Target stock will be a more attractive asset for investors.

In the second quarter of 2022, the retailer increased inventories 36% year over year to $15.3 billion, while total merchandise sales rose just 4% to $50.5 billion. The downside for Target in 2022 is that its inventories are growing faster than its sales. To fix this, the retailer needs to reduce unwanted inventory through margin markdowns. Because of this, the company's gross profit fell 670 basis points year-over-year. Operating profit was down 650 basis points, to 3.3 percent.

Analysts expect Target to stabilize that figure to 6% in the second half of 2022. Against the background of rapid growth in inflation and interest rates, experts' forecasts for the retailer's revenue do not look optimistic enough. Thus, the growth of this indicator for the whole year is expected at the level of only 4%. Analysts also expect a 41% drop in adjusted profit. However, the forecasts for the next year are more optimistic. The company expects revenue growth of 4% and an increase in adjusted profit of 48%.

On October 21, 2022, Target stock was trading at $155. This is the price we used as a basis for our price forecast for the retailer. We estimate that Target stock may trade above $190 in 2023. By 2025, according to our analysts, the company has the potential to grow to $300 or higher. The stock price will rise if the corporation is able to overcome inflationary pressures and stay afloat in times of crisis.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

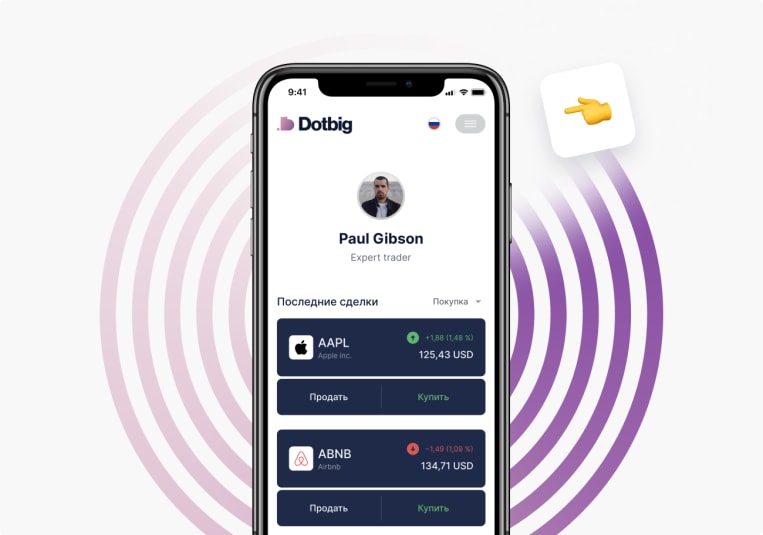

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading