Exxon Mobil shares can be classified as a sought-after stock market asset that attracts the attention of investors with its business stability and rising prices. This corporation is among the dividend aristocrats. This makes it an attractive asset for investors who are interested in dividend stocks with good returns.

Exxon Mobil Corporation is an American oil company that is the world's largest fuel supplier. The current corporation was founded in 1999 after the merger of Exxon and Mobil. An agreement to merge these organizations was signed in 1998 with a stipulated transaction amount of $73.7 billion. The merger of the two companies allowed them to reduce costs by $2.8 billion a year.

The geography of the company's operations is quite broad. The fuel supplier operates in the U.S., Canada, Singapore, France, Italy, and other countries. The corporation owns subsidiaries around the world. These include Ancon Insurance Company, Esso Australia Resources Pty Ltd, ExxonMobil Exploracao Brasil Ltda, and others.

Most of the corporation's revenue comes from refining and selling petroleum products. In addition to supplying fuel, Exxon is also involved in the production of various products in the chemical industry. Chemical plants are located in Belgium, the Netherlands, Britain, Thailand, and other countries. The corporation produces ethylene, polyethylene, and polypropylene.

Exxon is not only engaged in the production and sale of oil. Even if the demand for fuel decreases over time, the company will be able to keep afloat with other promising areas of activity. The oil giant is working on strategies to mitigate climate change. Exxon is exploring ways to produce blue hydrogen, low-carbon hydrogen that is produced by carbon capture and storage. This development will minimize the emission of carbon dioxide into the atmosphere.

The company unveiled a plan to buy back Exxon Mobil stock. The oil giant plans to allocate $30 billion for the buyback, which is three times the amount previously approved. If the corporation adheres to this plan, it will be able to buy back about 10 percent of all Exxon Mobil shares which are now in circulation on the stock market. This procedure would allow the company to reduce the number of securities in circulation and thereby reduce the number of dividends paid.

On August 15 Exxon Mobil shares fell by 3.3%. Such a drop in quotes was due to a sharp drop in oil prices due to concerns about the economic slowdown in China. The Central Bank of China unexpectedly announced the interest rate reduction. This is a sign that the government is concerned about the recession. Since China is considered one of the major oil importers, the pace of its economy has a significant impact on oil prices.

In mid-September, Exxon Mobil shares rose in price on some days. This is because oil prices are declining amid renewed fears about the onset of the recession. After the rally, investors took profits, so the oil giants' quotes went up. Despite the temporary subsidence in fuel prices, analysts predict an increase in oil prices to $150 per barrel in 2023. Experts attribute much growth in prices to the fact that at the moment demand exceeds supply in the fuel market.

The corporation ended the second quarter of 2022 with a net profit of $17.9 billion. This figure was up 280% year-over-year. Sales were below analysts' forecasts but were up 71% year-over-year. Free cash flow surpassed the $16 mark when you subtract $3.8 billion in capital expenditures from $20 billion in operating cash flow.

For the second quarter of 2022, analysts predicted Exxon Mobil's earnings per share of $3.74 if sales were at $132.7 billion. Sales for this reporting period came in below forecasts at $115.7 billion. However, the corporation's earnings per share exceeded experts' predictions and came in at $4.14.

Our Exxon Mobil stock price forecast is based on the corporation's market price as of September 23, 2022, which was $90 on that date. We also considered the company's growth rate and the state of international commodity markets. Based on our analysis, we can assume that Exxon Mobil Corporation stock will trade in the range of $91-98 in 2023. According to the optimistic forecast for 2025, the oil giant's quotes will exceed $103. If the fuel market remains volatile, Exxon Mobil's share price is expected to drop to $76.

To authorize on the website and create a personal account, fill out the form, indicating your name, phone number, email address.

After registration, provide an identity document to verify your age and place of residence.

To start trading real money, the initial deposit can be made in any available way.

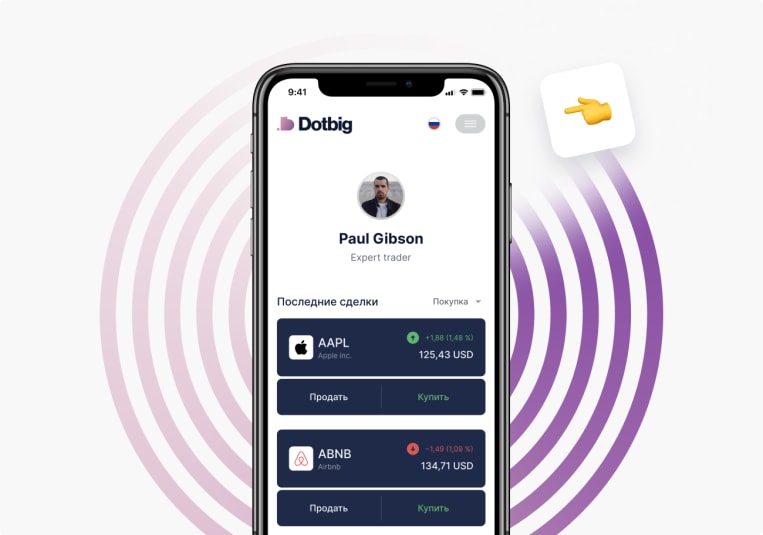

You can open/close deals on your own under the guidance of an experienced analyst or copy them from other traders.

No trading experience? Not a problem! With social trading, you can copy the trades of the best DotBig traders. Follow the rating and make a profit.

Start trading